Financial Stability—The Key To The Future

COLLABORATIVE POST

So recent thoughts were about what it actually means to have a stable financial life. Not that glossy magazine version where someone is holding a latte in a spotless kitchen, the common every day kind; the kind where you can breathe a little easier, because you are not constantly anticipating the next surprise bill or experiencing that tight, sinking concern when you open your banking app. Stability can't really be about wealth. Instead, it is more like living with a sense of steadiness and the sense of being able to live all you want without living in an ongoing state of doubt. A slightly messy one. You still have days where you think you’ve done everything right, and also days where you wonder how on earth you’re still learning the same lessons. Which, you’ll admit now, might indeed be part of the whole process.

1) Slowing Down To Gain Income

One of the most humorous things is our ability to go for so long without really knowing our own financial habits. You would race through your days and hope the best was the same. But a stable lifestyle begins with taking the time to look your money in the eye. That means going through your accounts, sometimes, even when you wouldn’t rather, and looking for patterns, and looking for pockets of stuff that’s leaking quietly. It doesn’t need to be perfect.

Perhaps you take a sip of your coffee once a week and scroll through transactions. You take a few brief notes here some days down on some scrap paper. Those tiny rituals can have a big impact. When you know what’s going on, you’re more grounded. And if you feel rooted, decisions seem a little more straightforward.

2) Creating Habits You Can Follow

Much financial advice is so prescriptive that it nearly guarantees you fail. But a financially stable lifestyle comes from healthy routines that are manageable, not punishing. You came to that difficult conclusion the hard way when you sought to scrap all of your budget in one sweaty afternoon. It lasted two days. Small steps work better.

Things like automatically transferring twenty dollars each week into savings or cooking at home an extra night to save something. Those don’t appear dramatic on paper, but take all the pieces. And because they are small, you are more likely to continue doing them. Stability isn’t loud. It’s typically pretty quiet and steady.

3) Letting Your Lifestyle Match Your Reality

We all enjoy the notion of living a certain way, and sometimes that doesn’t sit well in our heads. You used to pretend that you could maintain habits or spending levels that didn’t correspond to your actual income. It was exhausting. Once you move away from trying to impress an imaginary audience and start looking after yourself, things ease up for you. You may consider bringing in professional expertise that can assist in this daunting task.

Living within your means doesn’t have to feel like it is limiting. Often, it can be liberating because you quit trying to run after the version of yourself you aren’t even happy with. And when you’re living a lifestyle aligned with your actual life, the ground you’re on doesn’t wobble all that much.

4) Design A Budget That Fits Right

Budgets can have such an awful reputation. Some feel stiff. Others feel bossy. But, honestly, a budget should be a conversation with yourself. It turns as your life changes. It changes when seasons change. Some months are heavier. Some months are lighter. That’s normal. try to check in with myself the way I might with a friend I haven’t spoken to in some time.

But sometimes the conversation is brief. Sometimes it’s longer than I anticipated. But keeping up that dialogue allows me to recognize things early instead of waiting until I am in panic. And some, though not all of it — as part of that process, actually — you realize you have a kind of subtle financial security that gradually deepens under you before you even realize you have it.

5) Celebrating Your Progress

Financial progress is usually slow. Boring at times. It can seem as if nothing is changing — when in fact, it is all changing beneath the surface. Paying a bill on time. Refusing a surprise purchase. Choosing to cook instead of ordering out. These little choices warrant attention.

When you allow yourself to take pride in the personal gains, you reinforce the habits that bring stability. It’s a little easier to keep moving, even when you’re tired or frazzled or doubting your capabilities.

6) Conclusion

To end is not to have a perfect life. It’s about developing systems that help you and grow with you. Some months will feel smooth. Other times, you may feel like you’re juggling too much. But stability comes from working hard, being willing to continue learning, adapting, and being honest with yourself. The beautiful thing is that some stability doesn’t always seem loud or dramatic. Sometimes it’s just something with a still heart, a steady head, and the feeling that you’re slowly constructing a life that can support you.

— End of collaborative post —

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

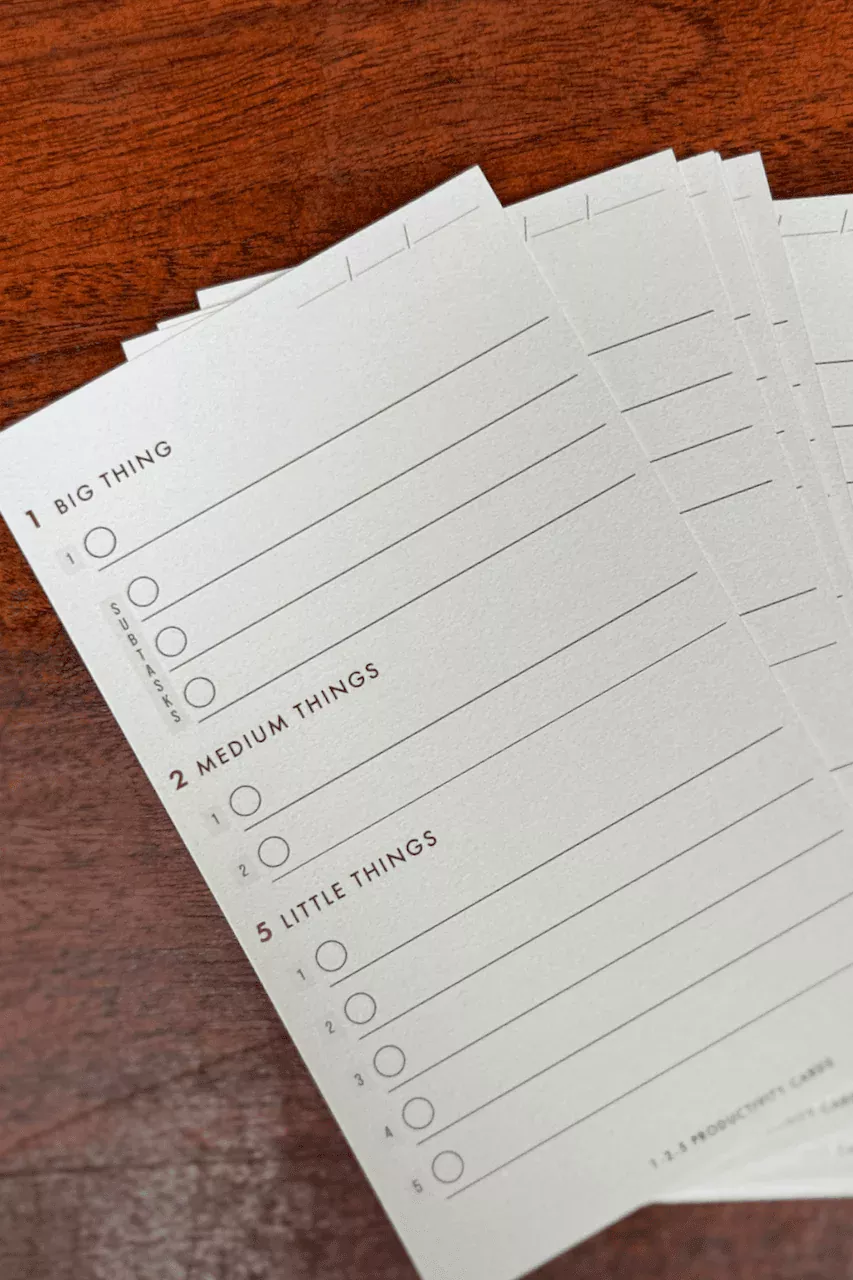

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

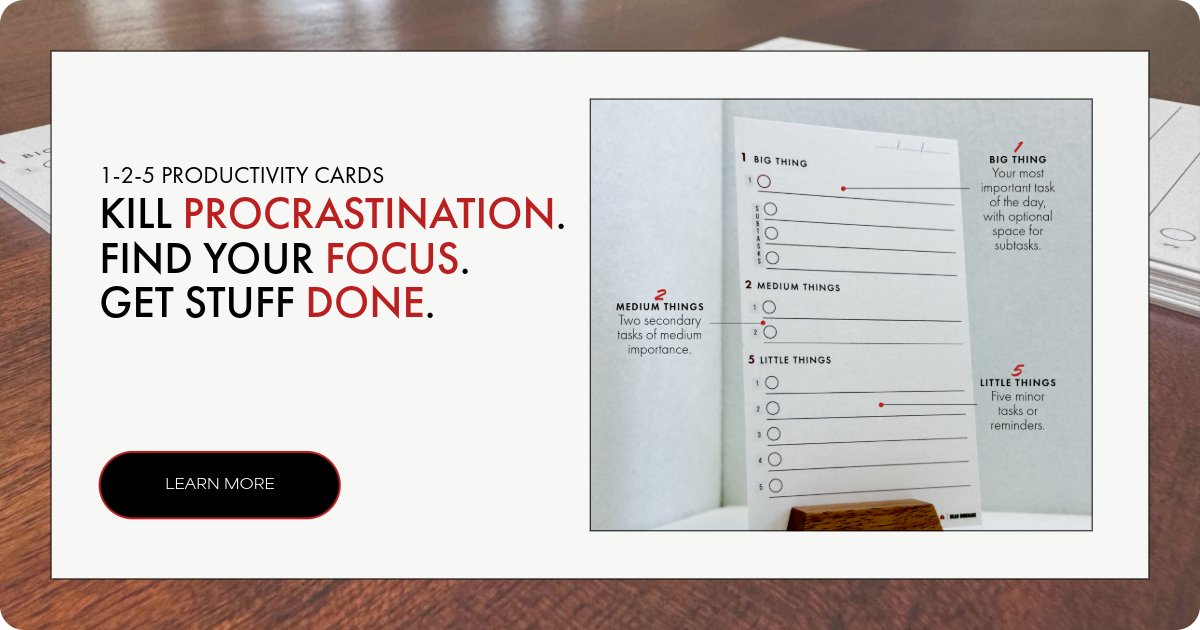

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport