The Power of Working

With Experts in Business

Collaborative Post

Smart financial management is vital for a business to see success, but it’s often one of the more complicated areas to focus on. Many entrepreneurs wouldn’t have much experience with it, after all. But, you shouldn’t have to struggle to manage your business finances.

Working on the right areas should be enough to make sure your finances are above board and as healthy as possible. There’s no reason why they shouldn’t help you with your margins, profit levels, and similar areas as time goes on.

Five of these could be more than worth focusing on because of the impact they can have moving forward.

Reduce & Manage Debt Wisely

As experts like Alex Kleyner note, debt is a significant part of life and can be driven by various reasons. In the business world, this can be used to invest in new equipment, upgrade your premises, and more. The trick to this is managing your debt wisely and only taking it on when it’ll fuel your operations and overall income.

Monitor Cash Flow Closely

Your cash flow is your business’ blood, and you’re not going to survive without it. This means making sure your cash flow is as positive as possible from as early as possible. To keep this healthy, forecast your cash flow as much as you can, invoice promptly, and ensure fair payment terms with each of your clients.Stick to Your Operating Budget

You would’ve already known to put together an operating budget for your business. But, you’ll have to make sure you actually stick to it as time goes on. Make this a priority. While small purchases here and there mightn’t seem too big, they’ll add up in time and could have more of an impact on your budget than you’d think. Stick to the budget as much as possible.

Invest in Financial Management Tools

Technology has upended how business owners manage their finances, and it could be a lot easier than you’d think once you’ve invested in the right tools. These can automate quite a few financial management tasks while giving you real-time insights into your company’s financial health. The impact these can have means you’ve no reason not to invest in them.

Plan for Taxes

Taxes are a significant expense for every business, but most owners only tend to think about them in the weeks before they need to file them. This usually ends up in a lot of stress as you try to make sure you can actually pay them. Avoid this by planning for your taxes and being proactive about putting money aside from them. It’ll avoid a lot of last-minute stress.

You’ll need to manage your business finances for more than a few reasons. It’s one of the more important areas for a business owner to look after. But, it’s also one of the more confusing areas you could have to deal with.

Thankfully, it doesn’t always need to be a struggle. Focusing on the right areas and taking the right steps should be more than enough to help with this.

—End of collaborative post—

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

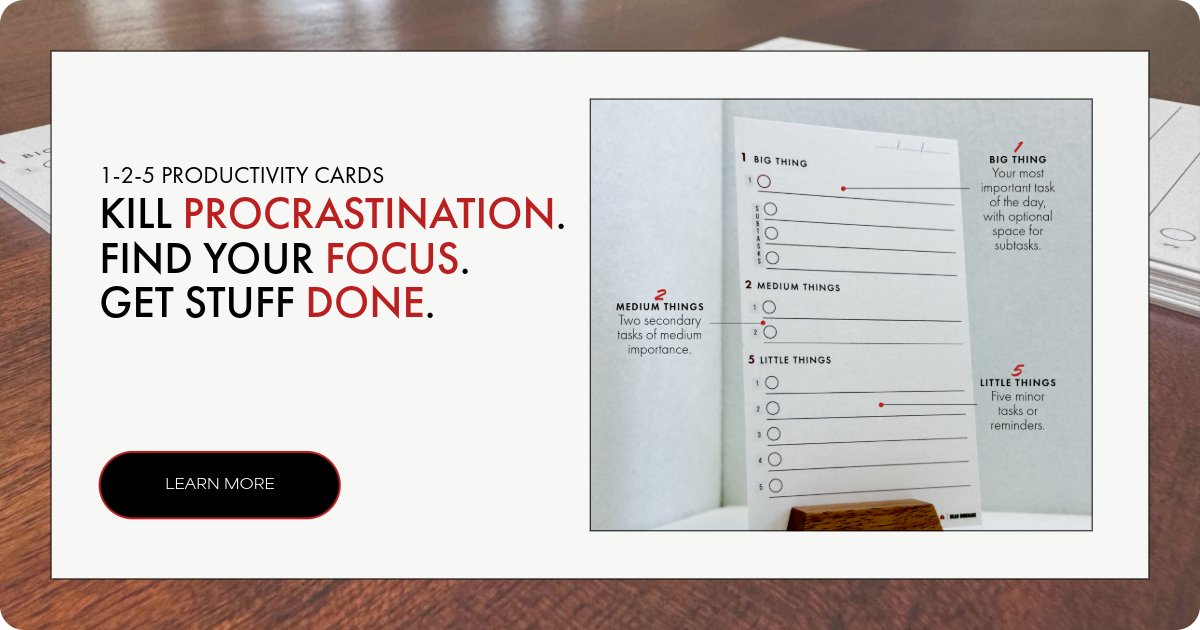

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport