Tips for Managing Investment Risk

and Maximizing Returns

SPONSORED POST

It’s generally said that money makes money, and investing is a great way to grow your money.

In fact, according to recent data, approximately 150 million Americans own stocks. This speaks to the widespread interest in investment opportunities among the citizens.

However, investing comes with risks, and managing those risks is crucial for maximizing returns. So, whether you’re a student or just starting your investment journey, it’s important to understand how to navigate the world of investments wisely.

Taking the same into consideration, in this article, we will share some simple yet effective tips to help you manage investment risks and accelerate your yield.

Let’s begin!

Diversify Your Portfolio For Balanced Growth

First-time or newbie investors often feel nervous about investing because they fear losing their hard-earned money. This is where diversification comes into play.

It involves spreading your investments across different types of assets, such as stocks, bonds, cryptocurrency, and real estate, to achieve balanced growth. By doing so, you reduce the risk of relying too heavily on a single investment. If one investment performs poorly, others may offset the losses.

It’s like having multiple safety nets. Diversification can help smooth out the ups and downs of the market and potentially increase your chances of earning consistent returns over the long term.

Research Before Investing

It means taking the time to understand the basics of investing and learning about the potential risks involved. It’s not just about knowing how to invest but also being aware of the threats that could affect your returns.

Let’s say you’ve invested in cryptocurrencies. In that case, it’s important to research and understand the risks associated with this investment type, such as market volatility and potential security vulnerabilities.

To mitigate these risks, you might consider securing your investment using a wallet, which is secure digital storage for your assets. Nevertheless, digital wallets are expensive due to the level of protection it offers.

So, you further need to research a ledger promo code to avail of these hardware wallets at a discounted price. Only then you will be at ease about the security of your digital assets.

In short, when you are investing, you need to conduct continuous research in order to mitigate risks and boost returns.

Regularly Review And Rebalance Your Portfolio

Think of your portfolio as a well-balanced meal, with each investment representing a different ingredient. Over time, the performance of your investments may vary, causing your portfolio to become imbalanced.

That’s why you must regularly review your portfolio. By assessing the performance of each investment, you can determine if any adjustments need to be made.

It may involve selling some investments that have performed well and buying more of those that have underperformed. It’ll ensure that your portfolio maintains the desired level of risk and aligns with your investment goals. Moreover, it’ll ensure you stay on track and take advantage of emerging opportunities while managing risks effectively.

To Sum It All Up

Managing investment risk and maximizing returns requires a thoughtful approach and ongoing attention. With all the tips given above, you can effectively manage risk and achieve financial success. Nevertheless, keep in mind that investing is a long-term journey, and patience and discipline are key.

—END OF SPONSOR CONTENT—

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

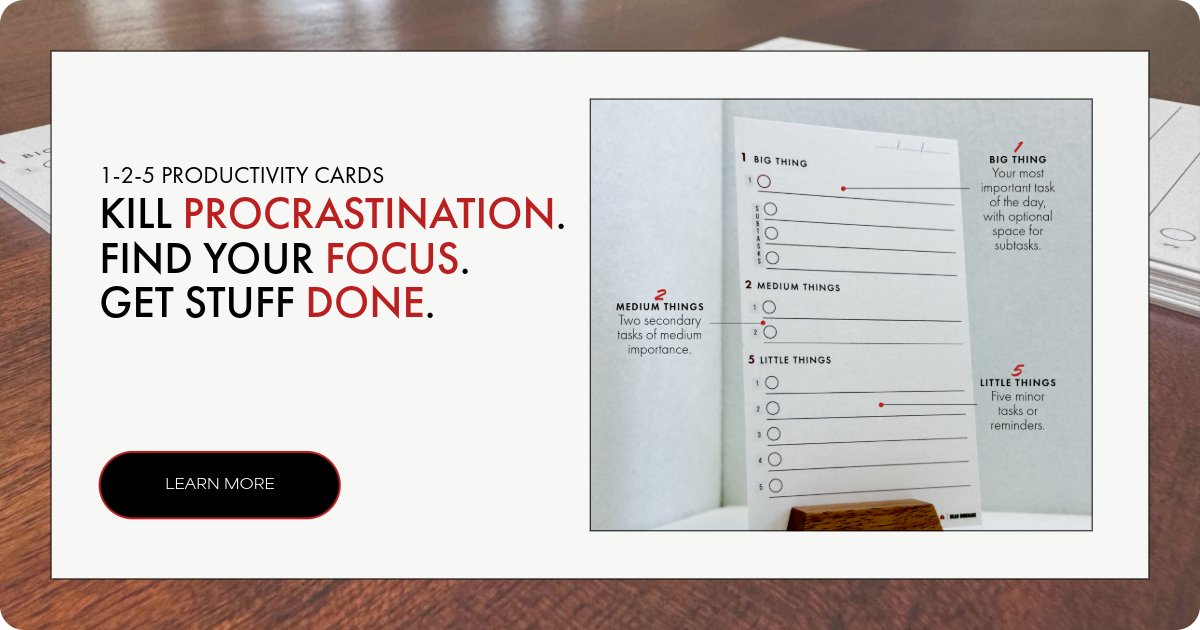

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport