The Ways That Personal Debt Can Impact Your Life (& How To Deal With Them)

COLLABORATIVE POST

Debt can impact your life in so many ways. Read about them below, as well as how to deal with them.

Mental health

One of the biggest issues that those of us in debt experience is mental health difficulties. It's hardly surprising, either, as the stress of being in debt and the anxiety of not knowing whether you will be able to make your payments each month are enough to impact anyone's emotional well-being.

Indeed, many people who are in debt worry so much that they struggle with getting to sleep and staying asleep, which can cause burnout, and so further compound the situation and make it harder for them to keep a stable job that would allow them to pay down their debts.

Debt can also make us feel ashamed of ourselves, especially if we keep it a secret or ignore just how bad things have become. In turn, that can have a very negative impact on our confidence and how we make other decisions in our lives.

Relationships

Unfortunately,y being in debt is something that doesn't just affect us, but also the people around us as well. It can cause all sorts of relationship issues, such as tension and arguments around money. It can also lead to not living a full life because of the worry about the cost of things such as holidays and nights out. Things that can further negatively impact a relationship.

Credit scores and borrowing

In addition to the emotional and relationship issues being in debt can cause, there are also long-term financial problems that can arise. These tend to be issues such as poor credit scores, which lead to higher interest rates when borrowing. Something that has a further knock-on effect of making it harder to get out of debt. Sometimes bankruptcy can be an issue, which can make it hard to get a loan for things such as a business or a house.

Picture sourced at Pexels - Licence CC0

Getting out of debt

There are several steps to getting out of debt that you will need to follow. The first is to embrace the advice of a debt expert, Alex Kleyner, who states that it's not just a technical issue but an emotional one too. By taking this type of humanistic, compassionate approach, you can avoid making yourself feel worse about your debt while also coming up with strategies to reduce it.

Next, it's important to take account of precisely what you owe, and create a realistic budget that allows you to pay this off while still living a decent life. Lastly, it can be helpful to explore all the options you have, such as consolidation, repayment plans, and even debt relief.

Vital things to remember

Last of all, it's crucial to remember that when it comes to personal debt, the sooner you can act, the better. This is because debt only grows if left untended, but you can save yourself a significant amount of money, as well as stress and hassle, if you begin to focus on paying off your debt.

Remember too that many people live their lives in debt and that there is nothing wrong with asking for help from experts and getting the support you need. Small actions now can make all the difference to your financial and emotional well-being in the long run.

— End of collaborative post —

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

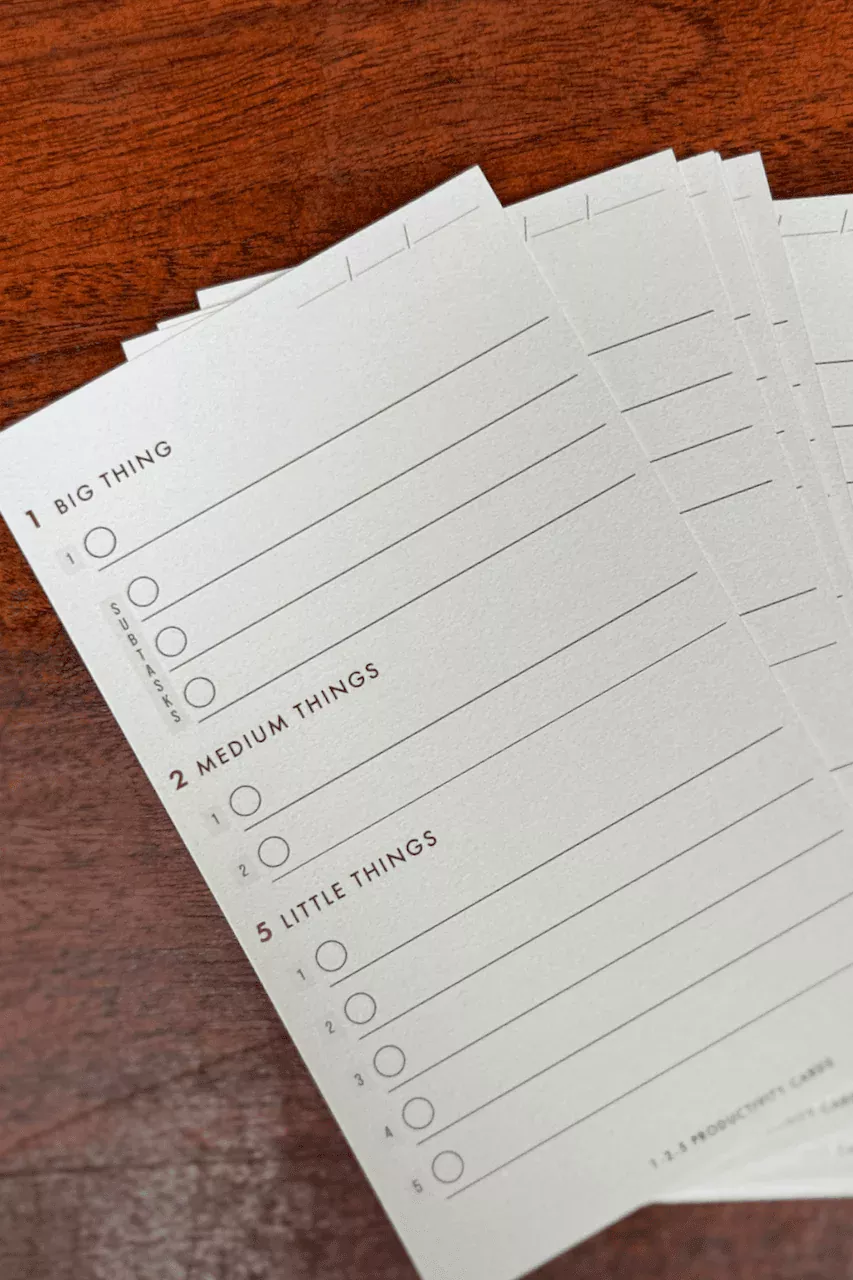

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

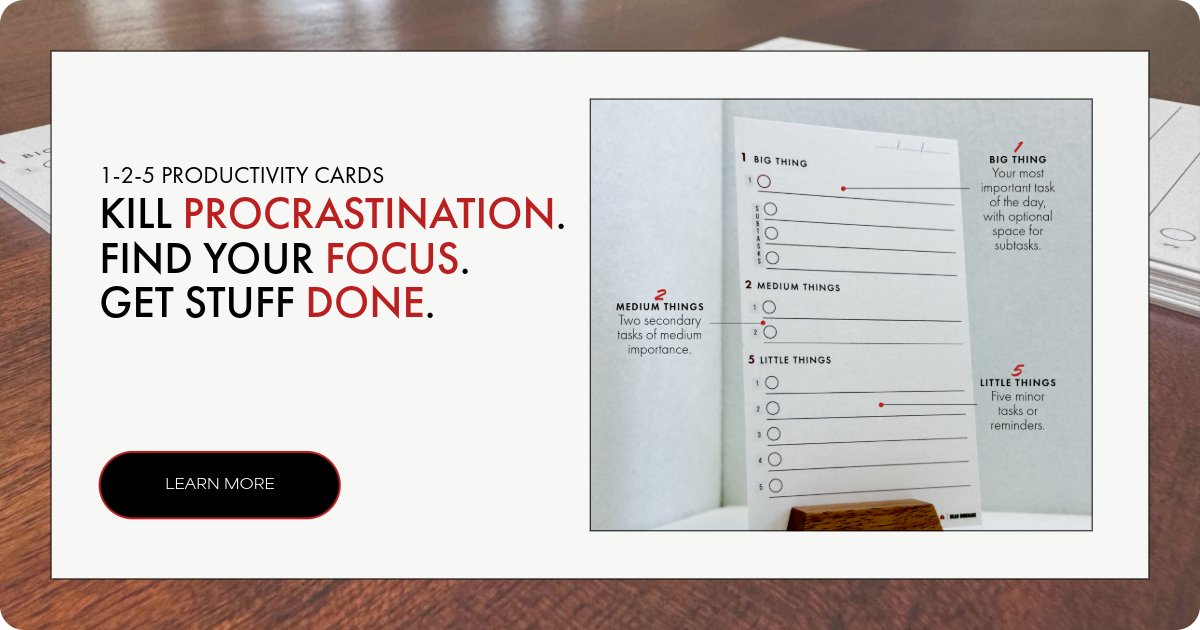

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport