The Smoothest Way to Financially Transition

Out of Student Life

COLLABORATIVE POST

It feels absolutely amazing when you reach graduation day, doesn’t it? It’s just a day where everyone’s cheering, cameras flashing, and it all feels like the start of this big, awesome adventure. Then a month goes by, and bills start rolling in (maybe you were already dealing with that prior, though). Well, the pain of adulthood would be the fact that there’s no more student discounts, no more campus freebies, and furniture, like actual decent furniture, basically costs more than your entire college wardrobe combined.

It’s like adulthood just barges in, kicks the door open, drops its bags on the floor, and goes, “So anyway, pay up.” Sure, that sounds silly, but that’s basically how it feels. For some people, they get lucky, their career could start basically tomorrow if they wanted it to, some get jobs lined up during school, some got a job from family members, others are stuck in a parttime job (like retail) until they get their first “real adult job for their career”, and of course there’s plenty that struggle to even get a single interview.

The shift from grabbing ramen with your friends to budgeting for literally everything is wild. There’s excitement, sure. Freedom’s great. But also, the financial pressure comes in strong before the stable paycheck does. It’s like two very different realities trying to share the same tiny apartment. And you better believe that middle part gets expensive real fast. So, how can you make a decent transition?

The Pricing Can be Whiplash

Well, just like what was mentioned just above here, during your student years, you’re so used to all those student discounts. Basically, college just had this weird way of spoiling people. There’s basically student deals everywhere. Cafeterias with prices that make sense (or it’s in your tuition),. Plus, housing is bundled neatly into tuition. Then, diploma in hand, the world’s like: “No more deals for you, buddy.”

It’s a little painful, because little luxuries will soon enough become full price, like streaming services want the grown-up pricing now (goodbye to that Spotify student discount). Groceries feel luxurious, and a casual trip to Target costs half your paycheck if you’re not paying attention to all those fun little purchases. Sure, you’ve been an adult this whole time, just maybe not as responsible, well, financially responsible at least.

Sometimes, Rent is the First Reality Check

Emphasis on “sometimes’ here, because it just really depends. Did you live in a dorm the whole time? Did your loans and scholarships cover housing? Did your parents? Were you in a student house? Were you somewhere where you basically had to pay little or close to nothing for rent? Well, this might be your first reality check, unless you move back in with your parents, of course.

Plus, if you live on your own, you also need to keep in mind that roommates in college are chosen because they’re chill or at least fun. But roommates in adult life are chosen based on how well they split the rent and, ideally, don’t steal food. The rent itself? Well, you can count on this eating your paycheck like it’s starving. Oh, and don’t forget utilities either.

Job Hunting Takes Time

Everyone kind of implies that getting a job after college is just step one… step two… done. But nope. You apply everywhere, write more cover letters than essays, stare at emails waiting for responses that aren’t coming yet. It’s honestly awful to say, but nowadays, it is a lot harder for new graduates to get a job, hence why earlier, it was stated there are the “lucky ones”. Employers are more picky, and it doesn’t help that AI seems to be taking away new entry-level positions.

So, you’re dealing with all of this, having to pay for transport (be it gas, bus tickets, etc.) to go to interviews, and you still have groceries, utilities, rent, and other expenses you still need to pay for. So, in this case, a lot of people will do gig work to help them out since an Amazon Flex background check isn’t tough to do, and with gig work, at least you can basically get a job the same day, or well, the same week.

You Need Side Income in the Meantime

Well, it’s just like what was briefly mentioned above. During that transitional period, you of course need financial responsibility, but it’s still about making income during that time too. So, in your case, this isn’t necessarily side income unless you’re doing multiple things for income. But it's not uncommon for someone to have a full-time job and do a side hustle, or someone who has the time to pick up multiple jobs and projects.

While gig work and odd jobs aren’t exactly ideal, it’s something that at least keeps your wallet alive. These aren’t always fun, but income is income, so when you’re not applying for jobs or doing job interviews for your career, then it helps to do this. Actually, it’s not uncommon to have a side hustle when you’re in an entry-level position because the pay starting out usually isn’t so great.

Expect Your Social Life to Get Weird

What does this have to do with the transition, though? Well, friends scatter everywhere. Some move home. Some launch into corporate life instantly and now have a “work personality.” Some disappear into adulthood like they went through a portal. Well, it’s all relevant here because a night out requires scheduling, budgeting, and convincing your future self it won’t ruin the week. But on top of that, menus start being judged by affordability. It’s weird, especially since everyone is a recent grad. But yeah, some people bond from struggling and being broke, so there’s that.

You’re Building the Bridge While Crossing It

Which is terrifying, of course, but this is common; a good chunk of new graduates all have to deal with this, actually. It’s an awkward phase, it’s uncomfortable, it’s annoying, but at the same time, this is a chapter of independence. This is basically where resilience really forms.

— End of collaborative post —

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

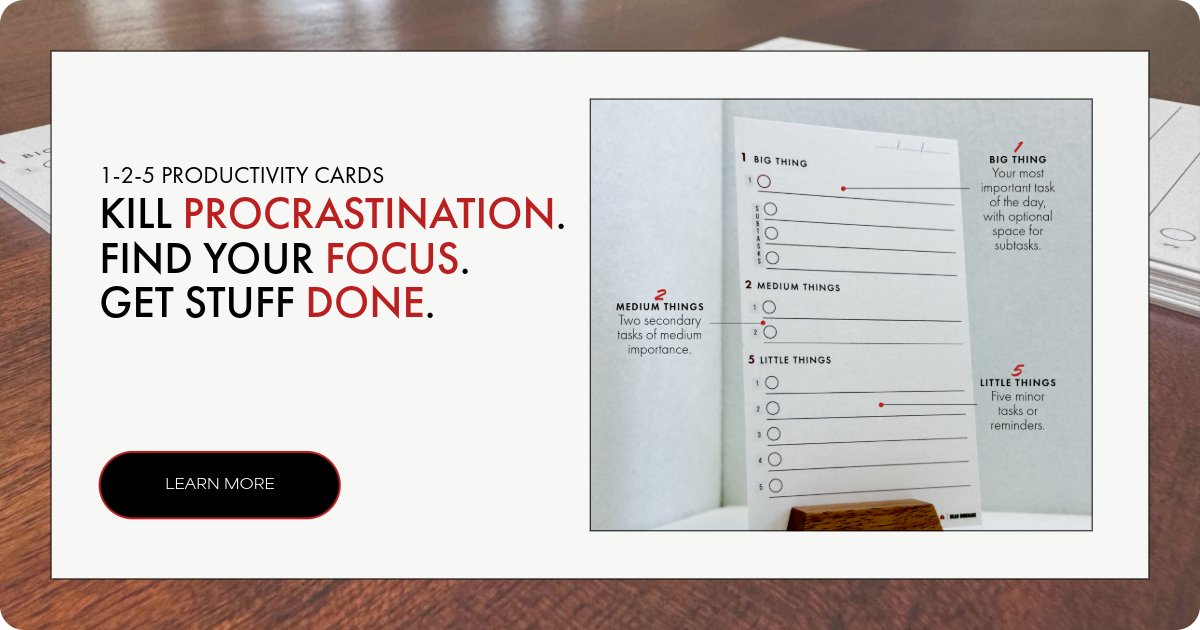

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport